Why Invest in UK Property from Türkiye?

The Turkish property market, while offering some opportunities, can be susceptible

to economic fluctuations and currency volatility.

The Turkish property market, while offering some opportunities, can be susceptible

to economic fluctuations and currency volatility.

This has led many Turkish investors

to look abroad for more stable and rewarding investment avenues. The UK property market, renowned for its resilience, stability, and growth potential, presents a compelling alternative.

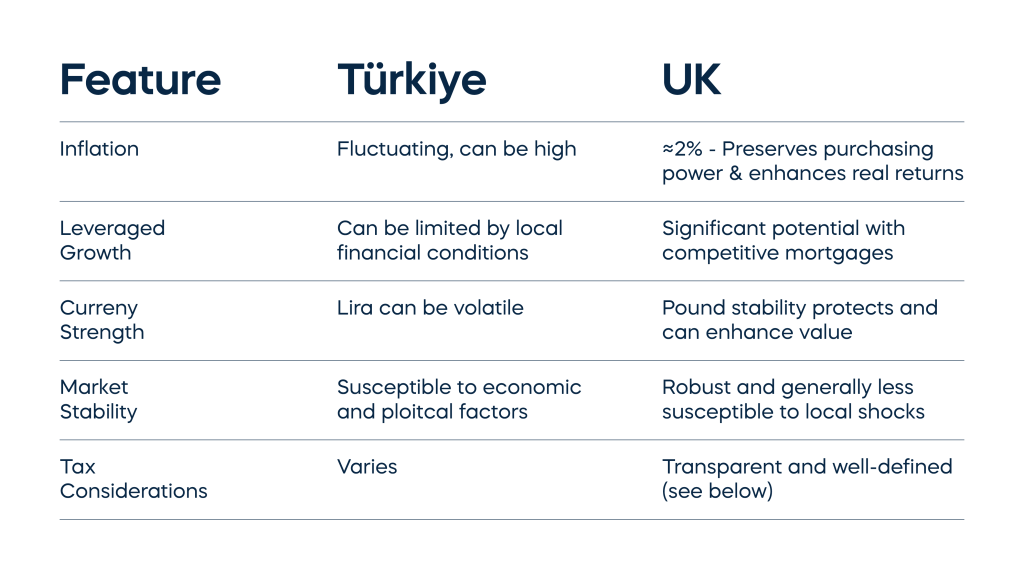

Several key factors make UK property an attractive proposition for Turkish investors:

While Türkiye has experienced periods of higher inflation, the UK maintains a more moderate rate (approximately 2%). This protects the real value of property investments, ensuring returns aren’t eroded by rising prices.

Reputable firms like Baron & Cabot, JLL, and Savills predict substantial growth in key UK locations, potentially reaching

between 25% and 35% over the next five years. This offers exciting prospects for capital appreciation.

The British Pound's stability compared to the sometimes volatile Turkish Lira offers a significant advantage. Investing in UK

property allows investors to benefit from potential Pound appreciation, safeguarding capital against currency devaluation.

UK banks offer competitive mortgage products tailored to international investors. With deposits as low as 35% and attractive interest rates, Turkish investors can leverage their capital to maximise returns. This strategy can significantly amplify gains compared tolocal investments, where inflation can negate nominal profits.

UK real estate provides a crucial hedge against local economic volatility and currency depreciation. For Turkish investors concentrated solely on the domestic market, UK property offers vital diversification and a robust mechanism for preserving wealth. The UK’s consistent ranking as the world's most transparent real estate market further reinforces its appeal.

Understanding the UK tax implications is crucial for maximizing returns. The system is transparent and generally favorable for international investors.

Rental income is subject to UK income tax after allowable

expenses. However, the personal allowance (currently around £12,570) means that income below this threshold may not be taxed. This can be particularly beneficial for initial investments.

Profits from selling UK property are subject to Capital Gains Tax (CGT) on gains exceeding the annual exempt amount. For non-resident investors, CGT is currently charged at 18% for

basic rate taxpayers and 28% for higher rate taxpayers. This straightforward regime provides clarity and predictability for investors.

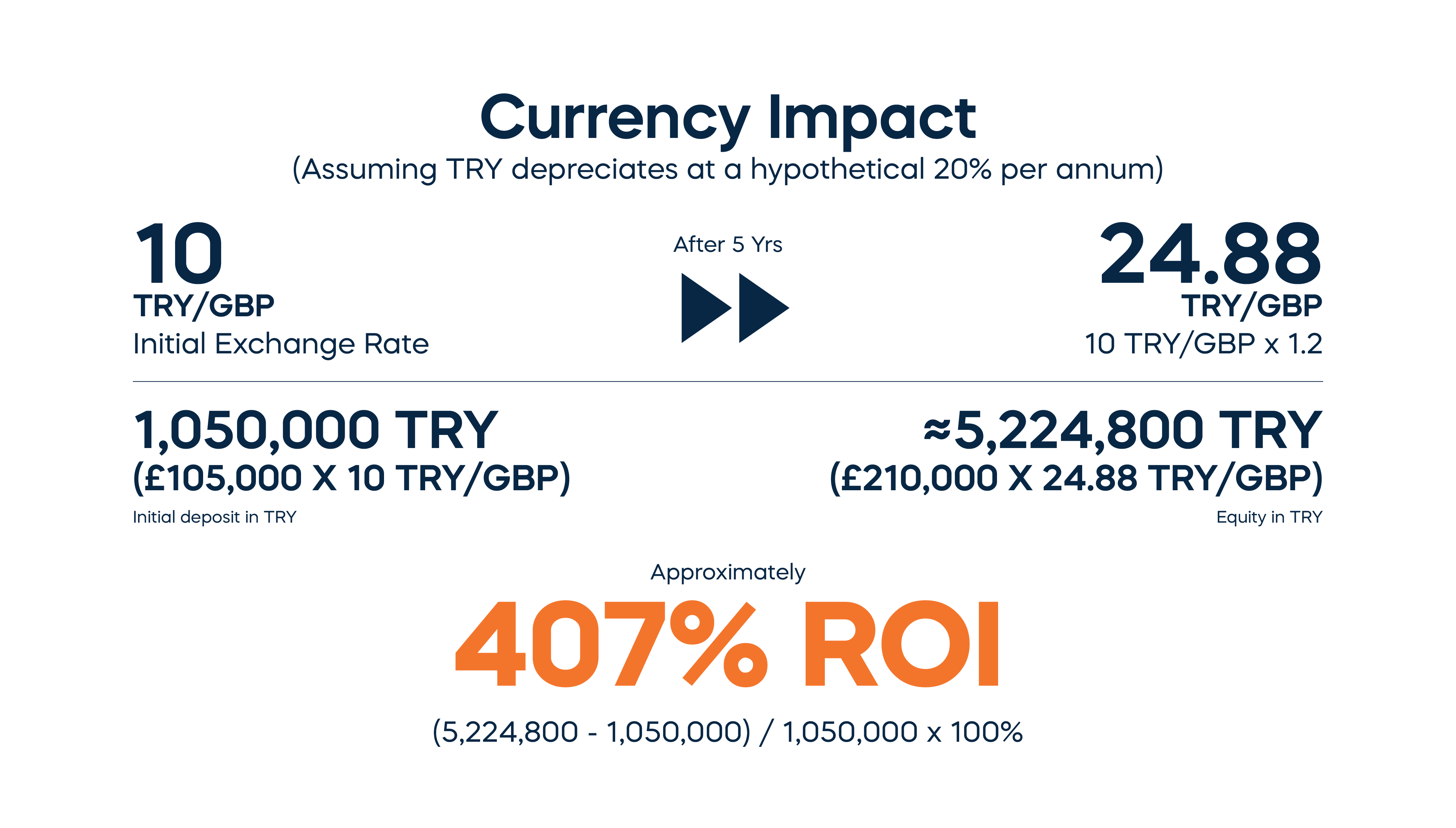

Consider investing in a UK property purchase with a 35% deposit OR Buying a property in Türkiye for the same amount – based on historical inflation and price growth.

Investing in UK instead of Türkiye you would have

(Assuming TRY Depreciates at a Hypothetical 20% Per Annum – This is for illustration, actual rates are variable and unpredictable, but depreciation is a significant concern):

Investing in UK property from Türkiye offers a powerful pathway to financial security and growth. Accessing a stable, high-growth market with controlled inflation, attractive financing options, and a transparent tax regime enables Turkish investors to achieve significant compounded returns on their equity. By leveraging a reasonable deposit in a strong economy, investors can outperform local investments hampered by potential inflation and currency devaluation.

Whether your goals include rental income, capital appreciation, or portfolio diversification, the UK property market offers a strategic opportunity to build lasting wealth and secure your financial future.

I have recently worked with Jason Tucker of Baron & Cabot on an investment property. Jason’s professionalism I will say was exemplary, he was able to unpack what will seem a convoluted process into a simple easy to understand process. From his response time, to providing investment analysis on various options and all-around client services was top notch. I will definitely maintain my relationship with Jason and his team as I grow my International investment portfolio. Omoh - NG

Investor

It has been the most efficient and pain free dealings we have had regarding our property search. Jason and everyone involved in the pro ess has been very professional, efficient and great to deal with Thank you. Will definitely be recommending Jason and Baron&Cabot to anyone I hear looking at buying property. Many thanks for the service.

Investor

This is our first time investing in the UK, it was scary at first, we had so many questions but the team was quite patient. They answered all our questions and also helped us build the trust we needed to start this journey. They were with us every step of the way, worked with and around our busy schedules- late night calls and zoom meetings- that for me was quite comforting. From the first meeting all the way to Exchange, they were professional. Thank you Lauren & Will for helping us throughout this phase.

Investor

Please request advice on the loan to value on a buy to let mortgage. While most would say 25% or 30% total deposit for a mortgage each situation can be unique.

At Baron & Cabot we pride ourselves in a full service for investors. As many of our investors are not UK based, and most of the remainder do not want to be hands on with the investment we offer a 360 process from sourcing, mortgage, currency exchange, legal support and managemnt of the property.

Often we will use 3rd party support to ensure the best possible price for our investors.

In our opinion we care more, we really focus on ‘confidence through clarity’.

We do the due diligence on developments which we will share with you. We will never carry a development which does not pass this criteria.

While there are some briliant companies in our market there are also some very lazy ones. If you have seen a development you like which we have not discussed with you, let us know, it may have failed our due diligence.

If you have any doubt’s what so ever speak to one of our staff. This is a normal concern and one we have a lot of resources for.

If you are an international client we will often work with a local bank of yours who you can speak to and ask about how many mortgages we have done together.

Alternatively, we have independent solicitors who can help, or even solicitors in your own country who can work with us to supply due diligence.

Finally, we have almost certainly worked with people in your city who we can also arrange a call with.

Property has historically provided solid returns through rental income and capital appreciation. It’s a tangible asset that can generate a steady income stream, making it an appealing choice for many investors.

Investing in buy-to-let properties with Baron & Cabot can make this venture even more rewarding. With our deep understanding of the UK property market and commitment to customer service, we can confidently help you navigate the buy-to-let landscape, turning a complex process into a straightforward and profitable journey.

Baron & Cabot have the benefit of being able to offer full market coverage to advise to our clients the best development for you without being restricted to particular developers.

In addition to full market cover as we tend to purchase large volumes in each development we are able to negotiate for you using the volume of the company (as an when this is possible).

Finally, developers are generally not client focussing and require companies like us to go to the market. As such most developers will be unable to offer discounts which we can negotiate, this is because they cannot be seen to be undercutting the market.

One of the great questions is protection on your investment. While no investment (in anything) is completely without risk, there are many ways we help protect you.

Speak to our staff about the due diligence conducted on each development and developer, all is available for you when needed.

In addition it’s likely that part or all of your money is protected with insurnace and other additional protection.

Each project is different so please feel free to request this information.

At Baron & Cabot we have in excess of 11,000 investment properties we have access to. We also have many projects which cannot be advertised due to being owned by our clients who are not actively selling but would be open to offers, or it may be properties we are due to release soon or may even be small developments we will sell to existing clients as there is no need to do a lot of marketing (as they will sell immediately).

By speaking to you our staff are trained in delivering not just the most suitable or best development, but also the most suitable unit in the development for you to consider.

Understanding your needs, price points and other factors significantly improves productivity for you our new client, and our staff, remove any calls or emails about properties which would not suit and make you more likely to find the ideal investment and buy through us which works for us both.

We are here to work with you as a business partner and ideally this starts with getting some understanding of your needs.

Yes we do!

No matter where you live in the world, no matter what currency you earn in, and even if you are retired we can help you!

Speak to our specialists who will get you an actual rate and get you in contact with the lender.

Rates are between 1.5% and 6% with up to 30 year terms. Rates depend on the country you live in, and your own financial circumstances.

Disclaimer: Any information provided by Baron & Cabot does not constitute financial advice and is for educational purposes only.