Have you ever considered investing in UK property but are unsure where to start?

If so, then you’ve come to the right place.

One unique feature that makes us stand out at Baron & Cabot is that we base our investment decisions on quality research to ensure private investors (like you) get the best return on their money. In this guide, we’ll walk you through some of the best places to invest in property in the UK based on critical metrics like rental incomes, capital growth, affordability, and demand.

Whether you’re looking for a solid property investment with the potential for strong returns or want to diversify your property investment portfolio, these locations have something for every investor. From the solid economic prowess of Birmingham to the bustling city of Manchester, the UK property market offers attractive opportunities if you know where to look.

The Best UK Property Investment Areas: Our Top 8 Picks

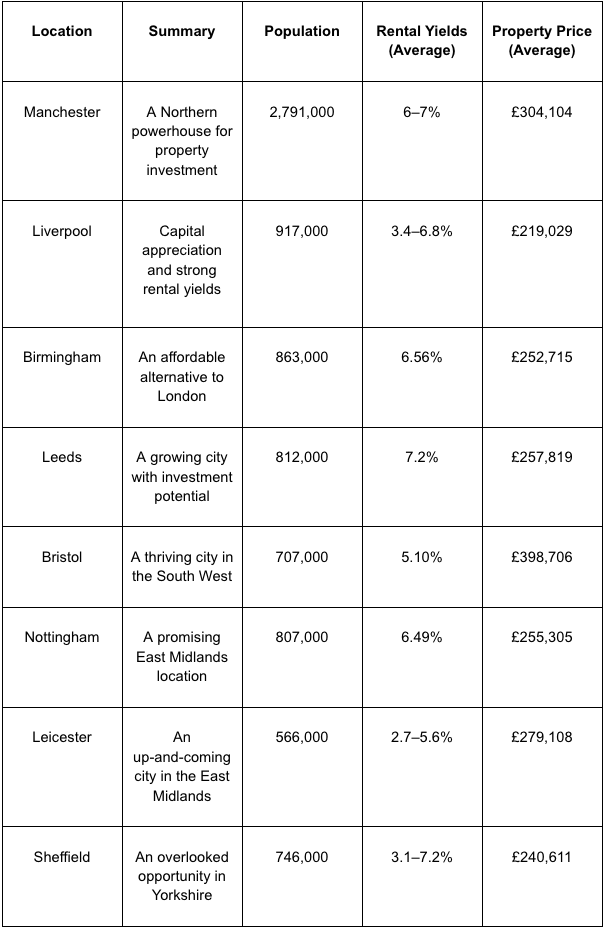

The following table provides an overview of the top real estate investment destinations across the UK, outlining key metrics and selling points.

#1. Manchester: A Northern Powerhouse for Property Investment

Manchester has firmly established itself as a leading city for those seeking the best property investment in the UK.

If you’re considering buying a property in the UK, here are a few reasons that make Manchester one of the best places to invest in the UK:

a. Rapid Population and Job Growth

Manchester’s population is growing at nearly double the national average, fueling colossal demand for housing. Major companies like Amazon, Google, and the BBC have also set up offices in Manchester, bringing high-paying jobs into the city. More people and more jobs mean higher demand for housing and steady rent growth.

b. Affordability and Strong Rental Yields

Average house prices and rents in Manchester are lower than in London, but rental income is higher. The average rental yield for a buy-to-let property in Manchester is around 6–7%, much higher than the national average of 4.75%. What this means is your investment will likely generate strong cash flow and high returns.

Check out our Manchester property listings to see how it became one of the most affordable locations and how you can have a slice of the real estate gold in this region.

c. Significant Regeneration and Infrastructure Projects

Billions of pounds of investment are transforming Manchester. Projects like MediaCityUK, NOMA, and the Oxford Road Corridor bring new homes, offices, leisure facilities, and improved transport links. This regeneration makes Manchester a desirable place to live and work, supporting property values and rents.

d. Top University and Young Population

Manchester is home to one of the world’s top universities—the University of Manchester—bringing over 40,000 students to the city each year since 2016. Manchester also has a relatively young, entrepreneurial population, ensuring a steady stream of tenants and buyers for your investment property.

***

With this city’s rapidly growing economy, urban regeneration, and ideal demographics, Manchester has cemented its status as the Northern Powerhouse of UK property investment. The city offers investors an exciting opportunity to benefit from capital growth and strong rental returns with residential property investments. Needless to say, Manchester should be at the top of any buy-to-let investor’s list.

#2. Liverpool: Capital Appreciation and Strong Rental Yields

Liverpool is a fantastic city and a top contender for the position of the best place to invest in property in the UK; here are a few reasons why:

- House prices in some Liverpool areas (like Albert Dock) have increased by over 40% in the last three years, showing no signs of slowing down. This implies strong capital appreciation for investors.

- According to recent reports, Liverpool also offers some of the highest rental yields in the UK, almost hitting the 7% mark. This translates into solid cash flow for buy-to-let investors.

- Liverpool’s economy is booming. Major establishments like Jaguar Land Rover, Liverpool ONE, and Liverpool John Lennon Airport drive job growth in the tech, finance, and tourism industries. With more high-paying jobs comes a higher demand for housing.

- Liverpool’s population is overgrowing. The city saw over 5,000 new residents in the last year alone, including many young professionals. This influx of people requires more housing, increasing property prices and rents.

- Liverpool has two world-class universities with over 50,000 students combined (1, 2). As a result, student housing is always in high demand, providing lucrative student property investment opportunities. Some students also remain in the city after graduating, becoming long-term residents.

- Liverpool offers an unbeatable quality of life. Beautiful architecture, a UNESCO World Heritage waterfront, exciting nightlife, culture, shopping, and dining make Liverpool an attractive place to live, work and invest.

Overall, Liverpool should be at the top of any property investor’s list in the UK. With solid fundamentals driving capital growth and rental demand, this dynamic city presents an opportunity for high returns and long-term success. If you’re keen on making a viable investment choice in this area, check out our Liverpool properties listing.

#3. Birmingham: An Affordable Alternative to London

If London property prices make your eyes water, then Birmingham should be on your radar. As the UK’s second-largest city, Birmingham offers investors an affordable alternative with solid future growth potential, making it the best place for property investment for many.

Property prices in Birmingham are around half the cost of London — the average home in Birmingham sells for £252,715 compared to £523,325 in London. Rent yields are also higher in Birmingham at 6.56% compared to 4.1% in London. This means when you invest in Birmingham, your money has to potential to grow faster, regardless of whether you buy to let or invest for capital appreciation.

Furthermore, Birmingham’s economy is thriving, with major employers in the banking, manufacturing, and technology sectors. Prominent companies headquartered here include HSBC, Jaguar Land Rover, and IBM: a growing population and job market fuel demand for property.

Transport links within and out of the city are also excellent. Birmingham has an international airport and is well connected by rail and road. The new High Speed 2 (HS2) rail line will cut travel time to London to just 49 minutes, making Birmingham an even more attractive commuter town.

The city centre has undergone massive regeneration in recent years. New Street Station, the Bullring shopping centre, and the Mailbox offer shopping, dining, and entertainment options for residents and visitors alike. Upscale apartments combined with commercial space in the city centre provide ample real estate investment opportunities.

While property prices and rents in Birmingham may never match London’s, its affordability, economic prospects, and improving infrastructure make it an appealing choice for investors seeking solid and long-term returns. Compared to other regional cities, Birmingham offers a competitive advantage for investors looking to benefit from growth outside the capital. You should check out our Birmingham properties listing to get started.

#4. Leeds: A Growing City With Investment Potential

Leeds, a city in West Yorkshire, has grown substantially and revitalised over the past decade. Once an industrial centre, Leeds has transitioned into a hub for business and culture in Northern England.

For property investors, Leeds offers an appealing combination of strong rental demand, solid price growth potential, and more affordable home prices than many other major UK cities, making it one of the best UK property investment areas. Let’s explore these perks in more detail below.

A Growing Population and Economy

Leeds is regarded as the fastest-growing city in the UK, with over 800,000 people and an economy worth £64.6 billion. The city’s economy has continued to improve, driven by financial services, retail, and transportation growth.

Significant employers in Leeds include Asda, Jet2.com, Sky, and the NHS. The increasing number of high-paying jobs has attracted more young professionals to Leeds, fueling demand for rental property.

Affordable Property With Room for Price Growth

While property prices in Leeds have risen over the past ten years, the city remains affordable compared to other large UK cities. The average home in Leeds costs around £257,819, significantly less than nearby Manchester (£304,104) or London (£523,325).

With a growing population and limited space for new housing developments, property values in Leeds are well-positioned to continue appreciating over the long run. Investors who buy now can benefit from future price growth.

Rental Solid Demand and Yields

Leeds has a large student population and young professional demographic, driving demand for quality rental property. According to Zoopla, the average rent for a two-bedroom apartment in Leeds is between £615 and £2,985 per month (1,2). For investors, this translates into healthy rental returns of around 7.2% for apartments and houses in Leeds. By comparison, yields in London and other expensive cities are 4.1% or less.

***

Leeds deserves consideration from any investor looking for an affordable city with a vibrant economy, demographic tailwinds, and the potential for solid long-term returns. While there are relatively lower property prices and rents than in other major UK cities, Leeds’ growth trajectory suggests it may not stay that way for long. For the savvy investor, now could be an ideal time to buy into the Leeds scene — check out our Leeds properties listing to get started.

#5. Bristol: A Thriving City in the South West

Bristol is a historic yet forward-thinking city in southwest England. And if you’re looking for where to buy property as an investor, you might have just found the right place.

A Cultural Hub

Bristol is a UNESCO City of Film and the UK’s first Cycling City. It hosts major events like the Bristol Harbor Festival and the Balloon Fiesta. With a thriving food scene, music venues, street art and nightlife, Bristol attracts young professionals and students, as seen from the below metrics and facts:

- Close to 60,000 students school at the University of Bristol and the University of the West of England.

- Vibrant cultural events throughout the year attract visitors and new residents.

- The city was ranked the UK’s best city to live in by The Sunday Times in 2017.

Strong Rental Demand

The influx of students and young professionals fuels the demand for rental accommodation in Bristol. The below figures and facts throw more light on how this influences the city’s property market.

- The student population has grown in the last few years, increasing the demand for housing and house shares.

- Bristol has a relatively young population with a median age of 34.3, way below the UK average of 40.7. Many young professionals rent before buying a home, meaning you can generate substantial yields from buy-to-let investments.

- At £1,941 per month, average rents in Bristol are higher than in surrounding areas (£1,190 per month), indicating strong demand.

Growing Economy

Bristol has a diverse, thriving economy based on aerospace, creative industries, IT and financial services. Significant employers include Airbus, Rolls Royce, Hewlett Packard and AXA Insurance. This has contributed to the city’s relatively high employment rate of 78.1%. Wages are also higher than average, with residents earning 32% more than the national average (£17.95 vs. £13.57).

***

With its vibrant culture, growing economy, and large student and young professional population, Bristol exhibits the fundamentals for a healthy rental market and property investment opportunity. The city’s popularity and increasing rents indicate the possibility of solid capital growth over the coming years for investors.

#6. Nottingham: A Promising East Midlands Location

Nottingham enlists as a prime UK investment hub for many, both locally and internationally, and for valid reasons outlined below.

A Strong Rental Market

Nottingham has a sizable student population, with two major universities in the city centre. This provides a consistent demand for student housing and helps support a robust buy-to-let market.

According to recent reports, rental yields in Nottingham average around 6.49%. While not the highest in the UK, these returns are still attractive for investors. The student housing sector, in particular, continues to perform well, making this place an excellent consideration for the best places to invest in property in the UK.

Affordability

With a lower cost of living than most other major cities, Nottingham remains one of the most affordable cities in the UK — our Nottingham property listings can confirm this. House prices and rents are well below the national average, with the average house price being £255,186 — much lower than cities like Manchester (£304,104) or Bristol (£398,706).

For buy-to-let investors, lower property prices mean lower barriers to entry and less capital required upfront. This allows you to achieve good cash flow and returns even with modest rent.

Regeneration and Infrastructure

Nottingham benefits from ongoing regeneration and investment in infrastructure. Several major development projects are underway, including redeveloping the Broadmarsh shopping centre and Nottingham Castle. New transportation links like the Nottingham tram system’s expansion also help boost the local economy. These types of long-term investments signal confidence in the future of Nottingham and help raise the city’s profile.

Amenities and Employment

Although Nottingham has a slightly higher unemployment rate than most UK cities (but still lower than Birmimgham and parts of Liverpool), the city still manages to provide job opportunities in sectors like healthcare, education, and professional services. The city also offers an appealing lifestyle with shopping, dining, arts, and outdoor recreational options.

In addition, Nottingham does have a charming city centre, an active music scene, and proximity to the Peak District National Park. These amenities and incredible employment opportunities attract residents and support property demand.

***

In summary, Nottingham deserves consideration as an investment location based on its strong rental market, affordability, ongoing regeneration, and amenities. For private investors, notably, Nottingham offers an appealing combination of solid returns and lower costs. In our opinion, Nottingham exhibits many of the attributes of an up-and-coming investment hotspot.

#7. Leicester: An Up-and-Coming City in the East Midlands

Leicester is an up-and-coming city in the East Midlands that should be on every property investor’s radar. Several factors make Leicester one of the best places to invest in property in the UK, including the following:

Affordability

Leicester offers affordable house prices for investors and homebuyers. The house prices there are well below the national average. The average house price is £278,108, compared to £285,000 nationally. Rent yields are also significantly high here at 2.7–5.6%, providing good returns.

Strong Economy

Leicester has a diverse, thriving economy with significant retail, healthcare, education, and tourism employers. Unemployment is low at 4.10%, and job growth is strong. The city centre has also seen lots of investment recently, with new shops, restaurants, apartments and infrastructure. This economic vitality and development mean demand for housing should remain high.

Transport Links

Leicester benefits from excellent transport connections to other major cities. It sits on the M1 motorway, linking it to London and Birmingham.

Leicester train station provides fast rail service to London, Birmingham, Nottingham and beyond. For international travel, East Midlands Airport is just 30 minutes away.

These strong transport links make Leicester an attractive, commutable city for workers and students.

Student Population

Leicester is home to two universities with about 45,000 students combined (1, 2). This large student population creates demand for student housing and private rentals. Investing in property near the universities is a wise strategy, as students will provide a steady rental income stream.

***

While property prices and rents may be lower in Leicester than in other cities, its affordability, economic opportunity and transport links make it an ideal location for buy-to-let investments. The city’s potential for growth means property prices and rental yields should increase substantially over the coming years. For investors seeking high returns at a lower cost, Leicester deserves a top spot on the list.

#8. Sheffield: An Overlooked Opportunity in Yorkshire

Located in the English county of South Yorkshire, Sheffield provides ample real estate investment opportunities to anyone looking to diversify his investment portfolio. Outlined below are the major factors driving property demand in this area.

An Affordable Alternative

Sheffield offers property investors an affordable alternative to other major UK cities. House prices in Sheffield are well below the national average, with the average home selling for about £240,000. Rent prices are also lower, making yields attractive.

For private investors, Sheffield’s lower costs mean higher rental returns — an appeal that makes it one of the best places to invest in property in the UK. Here are other plausible factors fueling this trend.

A Growing Economy

Sheffield’s economy has grown steadily over the past decade. Major employers include the University of Sheffield, Sheffield Teaching Hospitals NHS Foundation Trust, and Sheffield City Council. What’s more, the city has a growing tech sector, and with new businesses and job opportunities emerging, demand for housing should continue to rise.

A Student Rental Market

Sheffield has two major universities with about 60,000 students (1, 2), creating a sizable rental market. Student housing is always in high demand, and purpose-built student accommodation (PBSA) can generate yields of 5% or more per year. Many students also rent private homes and apartments, providing options for buy-to-let investors.

Transport and Infrastructure Improvements

Sheffield’s transport links are improving, making the city more attractive and accessible. Road and rail travel times to other Northern cities like Manchester and Leeds are around 45 to 60 minutes.

Sheffield also has an international airport and is on the proposed route for the UK’s High Speed 2 (HS2) rail project. Within the city, a new tram-train system and station upgrades are underway. These enhancements should boost Sheffield’s appeal to commuters, businesses, and property investors.

***

While overlooked by some, Sheffield ticks many of the boxes investors look for. For those seeking an affordable city with growth potential, Sheffield deserves a spot on your shortlist. With solid fundamentals in place and exciting developments ahead, Sheffield’s property market looks poised to gain more attention—and value—in the years to come.

FAQ: The Best Places to Invest in Property in the UK

Where can I find the highest rental yields?

Some of the areas with the best rental yields in the UK include:

- Nottingham: Nottingham, in the East Midlands, is home to two universities and provides good opportunities for buy-to-let investments, with yields of up to 8%.

- Manchester: Manchester is a major city in the North West of England with a strong economy. You can find 6–7% rental yields here, with strong demand from students and professionals.

- Liverpool: Liverpool continues to experience strong demand for rentals, with yields around 3.4–6.8%. It’s an affordable city with two universities, attracting students and young professionals.

Is property a good investment in the UK?

Property has historically been a stable investment in the UK.

Some reasons it continues to be attractive include the following:

- Strong demand: The UK has a housing shortage, with demand outpacing supply. This supports property values and rents.

- Tax incentives: The UK provides tax relief for investors, like capital gains tax (CGT) exemptions and tax deductions for expenses.

- Diversification: Property provides diversification from traditional stock and bond investments. It can help balance your portfolio and reduce overall risk.

- Leverage: Property allows you to leverage your investment through a mortgage, enabling you to buy an asset worth much more than your deposit.

- Income potential: Property generates rental income, which can provide cash flow and hedge against inflation.

- Capital growth: Over the years, property values in the UK have steadily increased, providing the potential for solid capital growth.

So, while there are risks to be aware of, as with any investment, property in the UK has the potential to be highly rewarding. Focusing on areas with strong fundamentals allows you to build a portfolio that provides income, growth, and stability for years.

Conclusion

This guide has thoroughly explored the best places to invest in property in the UK based on the numbers and metrics that matter. While London will always remain attractive as one of the best places to invest in property in the world, the UK has several other investment hotspots. The locations we’ve covered offer solid opportunities with strong growth potential at a fraction of the price.

Whether you’re looking for high rental yields, affordable housing markets, or locations with a bright future, one of these places is bound to pique your interest. The most challenging part will be choosing just one, and you can always contact us to guide you through this. Needless to say, you can’t go wrong putting your money into UK property!