According to data from the Building Societies Association (BSA), the average money in savings accounts in the UK is over £17,365, with some individuals having as much as £200,000 in residual income. If you’re fortunate enough to have access to funds of this size, you may be looking for the best ways to invest it for maximum returns.

With interest rates fluctuating in recent years, parking your cash in a savings account doesn’t allow you to take advantage of many promising investments with steady returns. What are these investment opportunities? Join us as we analyse the best way to invest £200K for maximum returns!

If you have £200K to invest, you have many options for generating solid returns over the next few years, including buy-to-let property developments, corporate bonds, and stocks or shares.

Based on our experience as property investment experts, the best way to invest £200K for high returns in 2024 and beyond is to purchase an investment property. To get started with a Baron & Cabot partnership, you need a 20% deposit for an investment property. This means you can use £100,000 to £150,000 as a down payment on a £500,000 to £750,000 buy-to-let (BTL) property; you can use the remaining £50,000 to handle property management fees.

But why do we recommend this route?

Buy-to-lets are a form of passive income investment, providing ongoing monthly income from tenant rent payments. These properties offer good rental yields, as high as 6%, depending on your location. Over the years, the property value is also likely to appreciate, allowing you to sell at a profit whenever you plan to exit. While you can generate passive income and accrue capital gains, there are many more benefits to investing in a buy-to-let, which we’ll address later on in this guide.

While BTL property investment offers solid returns, it also comes with risks like periods of low occupancy or tenants who default on rent. For the best chance of maximum returns, consider diversifying your £200,000 across multiple investment types.

You could put £150,000 into a buy-to-let property, then invest the remaining £50,000 in the stock or government bond market — perhaps in a low-cost stock index fund. The stock market (S&P 500) has historically returned 10.13% annually from its inception in 1957 through to the end of 2022. With £50,000 invested, that could mean returns of £25,000+ over 10 years.*

Tip: Check out our guide on whether you should invest in property or shares.

So, if you’re wondering how to invest £200K in the UK, a buy-to-let property or stock market can generate substantial returns by using this balanced investment portfolio approach. Another option you can consider is a real estate investment fund (REIT). However, they don’t offer the lucrative benefits of a traditional buy-to-let, as we’ll see when discussing their pros and cons later on. For now, let’s consider the various perks of buy-to-let property investment opportunities.

Property investment has significant advantages over other investment opportunities and options, including:

Property investments have historically achieved more substantial returns than more traditional investments like stocks and shares. According to statistics, when adjusted for inflation, UK property has achieved a return of about 365% over the last 7 decades.

Property investors can benefit from tax relief on rent income as provided by the UK property law. They can deduct expenses like insurance, repairs, and property management fees from rental income. Any capital gains from selling a property are also tax-free up to the annual allowance. Other investment options like cryptocurrency and stocks and shares offer fewer tax benefits.

The property market is less volatile than stocks, government bonds, or cryptocurrency. Property values tend to hold up well during market downturns and economic recessions, proving its resilience. Rental demand also remains fairly stable, providing an income even when property prices fall.

It’s possible to invest in property using a mortgage, allowing you to leverage your investment. Even a small initial capital outlay can give you control over an asset worth many times more, enabling potential higher returns. On the other hand, leverage is more limited and complex for other investment types.

In summary, with high returns, tax benefits, stability and the ability to leverage, property investment has significant advantages for higher returns over the long term compared to other options like cryptocurrency, stocks and shares, or even some businesses. For investors with £200K to invest, property could provide an ideal opportunity to achieve substantial returns.

However, location is a key determinant of a property’s value. Hence, selecting the right location is one of the many property investment tips for securing good returns. But what is the best location for maximum return? Continue reading to discover our top picks at Baron & Cabot.

At Baron & Cabot, we recommend purchasing a property as the best way to invest 200K. However, the key to building a profitable property portfolio is finding the right locations worth the potential for strong growth.

Here are the top 5 places in the UK to invest £200,000 in property for maximum returns:

Manchester is a major city in England’s North West that continues to attract companies and young professionals. Values of detached buildings have appreciated by more than 60% in the last decade and are projected to continue rising in the next five years due to strong demand and limited supply.

For £200,000, you can acquire a spacious 2-bedroom flat or invest in a buy-to-let property. Manchester’s economy is thriving, with major employers in industries like tech, finance and e-commerce. This dynamic job market and affordable cost of living appeal to both students and young professionals, ensuring a very steady income stream for renters.

Birmingham is a major city in England’s West Midlands region. The price of detached buildings has increased by over 70% in the last 10 years but remains below the national average, indicating room for solid growth.

Major infrastructure projects like the arrival of HS2 are improving connectivity and catalysing new housing and commercial developments. Also, the city’s diverse, service-based economy boasts many large employers in sectors like banking, retail, and healthcare. With £200,000, you can invest in a multi-unit property development or purchase a 3-bedroom apartment.

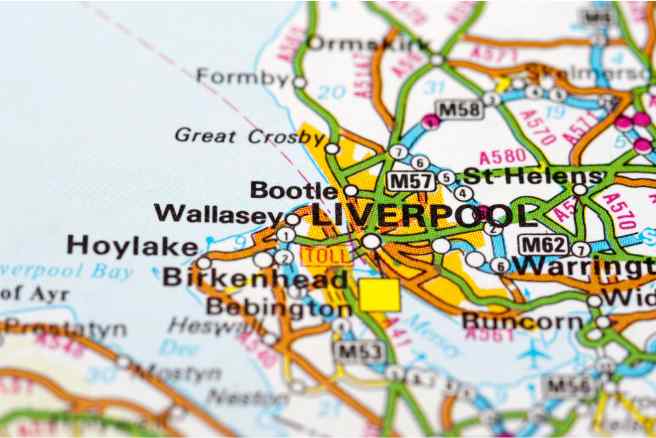

Liverpool is a port city in North West England along the River Mersey. It’s a city rich in history, culture, nightlife and outdoor attractions.

Detached buildings’ value in the city has increased by over 50% in the last ten years. You can invest in the city’s housing market by purchasing a new-build investment property to rent out. This is a great way to take advantage of Liverpool’s stable base of renters and buyers supported by its universities and hospitals.

Edinburgh is the capital of Scotland, a historic city set against the backdrop of Edinburgh Castle and Arthur’s Seat. Property prices have appreciated over the last decade, but values remain affordable compared to other major UK cities. New developments around Edinburgh Airport and strong tourism are driving housing demand.

For £200,000, you can acquire a 1–2 bedroom flat, especially in up-and-coming neighbourhoods like Leith or Gorgie. Edinburgh’s economy is based on finance, tech, education and healthcare, with two major universities ensuring a consistent supply of student renters.

Cardiff is the capital of Wales, known for its vibrant culture and rich history. Over the past decade, detached buildings in Cardiff have seen a property price increase of about 60%, yet prices remain competitive compared to other UK cities. With a £200,000 budget, you could purchase a two-bedroom flat in the heart of the city.

Cardiff is currently undergoing numerous infrastructure improvements, including Central Square’s regeneration and the Cardiff Bay Barrage. The local economy is robust, with significant employment in public administration, education, health, and an emerging creative sector. These factors make Cardiff a potential hotspot for property investment.

Investing in these areas is a great way to enjoy significant returns on your £200K investments. As we’ve earlier hinted, another way to achieve annual growth on your £200K capital is via REITs. Let’s examine the perks and risks associated with this investment option.

Investing in Real Estate Investment Trusts (REITs) is one of the best ways to invest 200K for passive income. It allows you to invest in property without direct ownership of physical real estate.

According to reports, REITs generated an average return of 9.7% (year-on-year) between 2009 and 2019 — higher than most major asset classes. However, while REITs offer lucrative returns, they also come with risks that you must consider before investing.

Here are 5 key things to consider before investing in REITs:

REIT shares are publicly traded, so you can buy and sell them easily on the stock exchange, giving you flexibility and access to your funds. This contrasts with direct property investments, which are illiquid, often tying up your capital for years. While the liquidity of REITs allows you to exit your investment quickly if needed, understand that buy-to-let property investments are designed to yield the most returns over the long term.

REITs invest in a range of property sectors and locations, enabling diversification that would otherwise require a large portfolio of direct properties. Investing in REITs exposes you to commercial, industrial, residential, and speciality real estate sectors across geographic regions. This diversification reduces risk versus investing in a single property type or location.

REITs are managed by experienced property professionals who source and manage the properties. They have the expertise to maximise returns that many individual investors lack. The professional management of REITs is a benefit, especially for inexperienced property investors.

REITs are tax-efficient structures, only paying Capital Gains Tax (CGT) on property sales. They avoid Corporation Tax by distributing most of their income as dividends to shareholders — this means higher returns for investors. Compare this to direct property investments, where profits, dividend income, and capital gains are subject to Income Tax and CGT.

While REITs offer significant benefits, risks of this property investment strategy include susceptibility to market forces and overexposure to certain property sectors. So, if you have £200K to invest, understand that REIT values can decline with the overall stock market, and sector-specific REITs amplify risks associated with that sector. REITs may also employ leverage, which further amplifies risk.

What’s more, REITs don’t provide the benefits that make real estate investments lucrative:

In summary, REITs offer a profitable way to invest in property due to benefits like liquidity, diversification, tax efficiency, and professional management. However, these perks don’t compare with what you stand to gain from property investment. Moreover, when you partner with UK property investment experts, you have the option of outsourcing property management responsibilities to a professional lettings and property management company like Redstone.

Investing in buy-to-let properties is the best way to invest £200,000. It offers long-term returns through both rental income and capital appreciation. Diversifying your investments into stocks and shares can also be a wise strategy, as it helps spread risk and potentially increases overall returns. Remember, all investment decisions should be made with careful consideration — ensure to consult a professional.

Investing £200,000 in property can earn you an interest equivalent to the average UK rental yield of 5.49%.

If this yield remained consistent in 2024, and you invested in a buy-to-let property, your investment could potentially generate almost £11,000 annually in rental income or more if you leveraged a mortgage to buy a property with a higher value. This would be significantly more than the annual £10,500 you’d earn from cash savings accounts with the current 5.25% interest rate — considering the rates remain stable.

However, property investment also involves costs and risks that need consideration. So, consult a reputable UK property investment expert for the best way to invest £200K based on your individual circumstances and goals.

If you’ve inherited £200,000 in the UK, there are several smart ways to use it. You could spread it across cash ISAs and stocks & shares ISAs, taking advantage of tax-free savings and investment opportunities. While investing in financial instruments such as stocks, bonds, foreign exchange, and commodities can offer potential long-term gains, buying property developments is another profitable venture, given the potential for rental income and capital appreciation.

Remember, it’s crucial to diversify your investments and seek professional advice to tailor your strategy to your financial goals and risk tolerance.

Turning £200,000 into £1 million won’t happen overnight, but with smart investing strategies, it’s feasible. Investing in a diverse portfolio of high-yielding property and fast-growing stocks can potentially yield significant returns over time. When considering how to become a millionaire with 200K, it’s also worth looking into investments in bonds, European and Japanese equities, and dividend-paying US stocks.

Remember, this process involves patience and risk tolerance. Consulting a financial adviser can help you navigate these complex decisions and craft a personalised investment strategy.

While it’s technically possible for a millionaire to live off interest, the lifestyle it affords can vary greatly. With a 5.25% interest rate, a £1 million investment would generate £52,500 annually. While this steady income stream is certainly not insignificant, it may not support a lavish millionaire lifestyle, especially in high-cost areas.

Factors like living expenses, inflation, and changes in interest rates can also impact the sustainability of this approach. Hence, many millionaires prefer to diversify their income sources, combining interest income with other investments or business ventures, e.g., buy-to-let property investments.

Based on our experience and historical performance, buying a buy-to-let residential property, whether through purchasing flats or houses, is the best way to invest £200K and achieve a strong return over the long term.

With interest rates peaking and likely to reduce in 2024, mortgage lenders are inclined to slash rates, making property purchases more appealing. Also, the demand for rental accommodation continues to rise across much of the UK, especially in major cities.

If you do your research, find the right property in an ideal location, and are prepared to properly manage your investment, you have the potential to generate an annual return of 5% or more. The capital gains that accrue over the long term also increase your property value if you decide to sell in the future.

Contact the Baron & Cabot team for advice on the best places to invest in property in the UK.

Disclaimer: Any information provided by Baron & Cabot does not constitute financial advice and is for educational purposes only.